What is an HS commodity code?

The Harmonised Tariff System was developed by the World Customs Organisation (WCO) in 1988. The objective of introducing the HS tariff was to make customs easier by classifying goods in the same way across the WCO’s 200+ members, meaning that goods could be easily identified no matter where in the world they were going.

To do this, goods would be classified using the same six-digit codes, with members of the WCO adding additional numbers for their own needs.

Using HS codes, customs would no longer need to decipher descriptions or physically inspect goods to understand what they were. Additionally, the use of numbers is globally understood, whereas relying on English or another international language is not as foolproof.

However, the six-digit HS code is only the beginning of the commodity code – to which countries add more numbers so that they can impose import tax rates, sanctions, licence requirements, and other regulations.

How is an HS code structured?

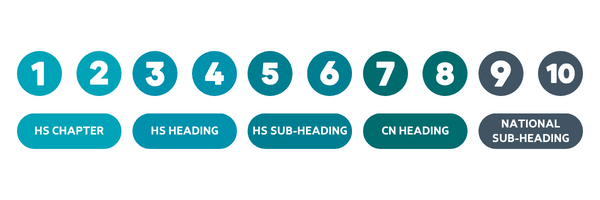

HS codes are made up of six digits, bringing together three pairs of numbers to ascertain the chapter, heading, and HS subheading for the category of goods. Using these six digits as a base, countries add their own endings for use in export and import customs clearance.

This is why you can see six-, eight-, 10, and even 14-digit variations of a commodity code on your paperwork.

Here is how a 10-digit code would be made up:

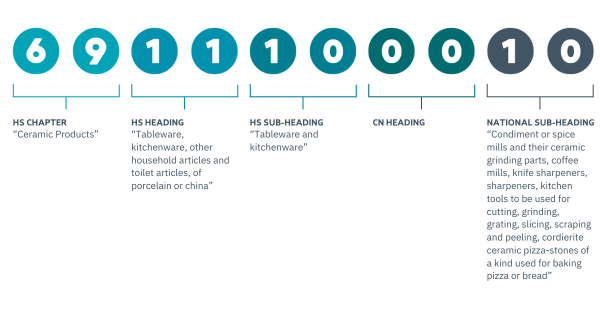

And here is an example of what this means in application:

As you can see, each subsequent pair of numbers gives further context to the product.

HS tariff sections

Although the chapters of the HS tariff are the first part of a commodity code, chapters are bundled into sections within the full list of goods. Sections also have a progressive logic to them, although there is some overlap and circling back.

Here are the sections outlined:

- Section one (chapters 1-5): live animals

- Section two (chapters 6-14): vegetables and vegetable products

- Section three (chapter 15): animal and vegetable oils

- Section four (chapters 16-24): prepared foodstuffs*

- Section five (chapters 25-27): minerals

- Section six (chapters 28-38): chemical products

- Section seven (chapters 39-40): plastics and rubber, and articles thereof

- Section eight (chapters 41-43): consumable animal and plant products

- Section nine (chapters 44-46): wood and articles thereof

- Section 10 (chapters 47-49): pulp of wood and other fibrous products, paper and articles thereof

- Section 11 (chapters 50-63): textiles and articles thereof

- Section 12 (chapters 64-67): footwear, headgear, umbrellas, walking sticks, whips, and other articles

- Section 13 (chapters 68-70): non-metallic mineral products - stone, plaster, cement, ceramic and articles thereof

- Section 14 (chapter 71): precious metals and stones, pearls, imitation jewellery, coins

- Section 15 (chapters 72-76, 78-83): base metals and articles of base metals**

- Section 16: chapters 84-85: machinery and mechanical equipment for sound and imagery, and accessories thereof

- Section 17 (chapters 86-89): specialised machinery for the transport sector

- Section 18 (chapters 90-92): optical, cinematic, measuring, musical and medical apparatus and instruments

- Section 19 (chapter 93): Arms and ammunition

- Section 20 (chapters 94-96): miscellaneous: toys, furniture, games, signs

- Section 21 (chapters 97-99): works of art and tariff provisions reserved for special use

*Although these are included within section four, chapters 22 and 24 are excise goods (alcohol and tobacco). Chapter 23 is for animal food and waste products. Therefore, it is widely understood that chapters 21 and below are for agricultural goods, with most attracting agricultural duty.

**Did you notice that chapter 77 is in section 15 but we removed it from the list? That’s because there are no HS codes in chapter 77! This chapter is reserved for metals that theoretically exist but have not yet been discovered or traded.

As you can see from just the first two numbers of HS codes, some goods could be classified into multiple chapters. This is why it is essential to work with a customs consultant on your goods classification.

When do you use longer commodity codes?

Sometimes, you don’t need the full 10-digit commodity code. An example of this is during export clearance, when there is no import duty and VAT or special conditions of import to consider. In this case, eight-digit codes are mostly used.

There are some situations where you need more information than the typical 10-digit commodity code provides, and this is where you might see a 14-digit commodity code. Technically, this is the 10-digit code and a four-digit additional code, entered in a different box during customs clearance.

Additional codes are reserved for commodities where greater specificity is required on the goods for tax or quotas. For example, to give information on the volume of sugar inside a beverage.

Need help with HS codes or classification?

Customs Support is here for you. Our consultants work with businesses like yours throughout Europe and globally to help with classification, changes in commodity codes during processing, obtaining legally binding tariff advice, and more. Contact us for more information.